Finance Day is an important event, generating a lot of interest as we examine what affects our finances. While the reality of taxes is something we all face, what we are most concerned about is how these changes affect our take home pay, especially for salaried people. Let’s break down this year’s Budget and see what it means for you.

As we adapt to these changes, focus on what you can control: your growth and income. Investing in yourself and working to improve your earnings can make a big difference. Although taxes are a constant, controlling your financial future is in your hands.

Changes to your tax return:

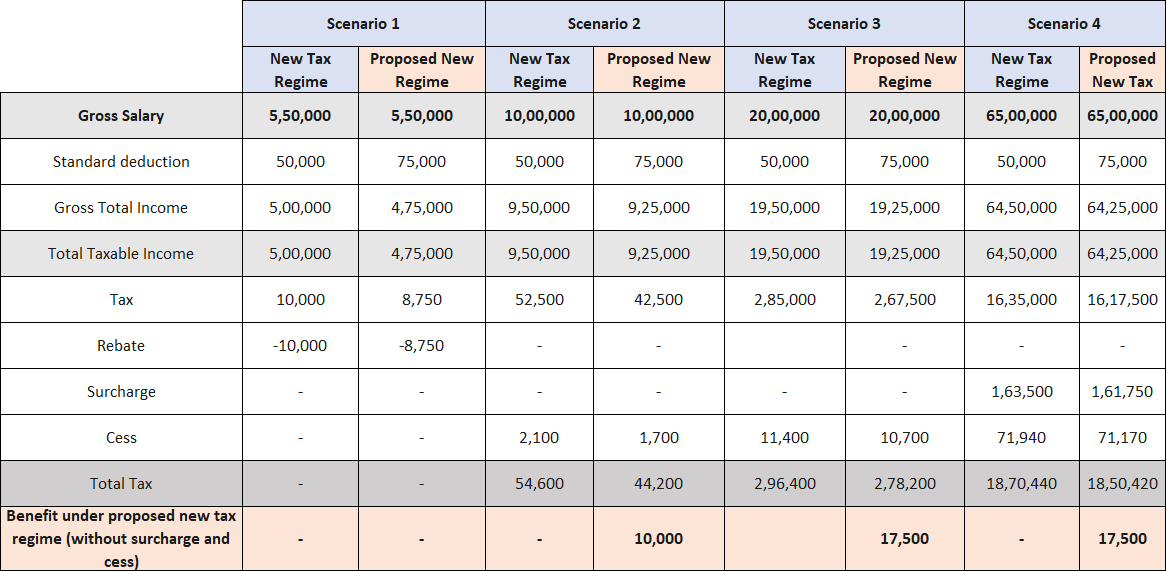

The budget has improved the tax bases of the new tax system to strengthen its appeal to taxpayers. Under this regime, the standard deduction is set to increase from ₹50,000 to ₹75,000.

Pay no Tax on Income up to ₹7.75 Lakh

The recent changes in tax slabs will result in huge savings for the lower and middle classes, while those in the higher brackets will see less impact. These reforms allow salaried employees in the new tax regime to save up to ₹17,500 in income tax.

The maximum deduction of ₹ 75,000 means that anyone with an annual income of ₹ 7.75 lakh will not have to pay tax. Besides, under the new regime, taxpayers with an annual income of up to ₹7 lakh are eligible for full tax deduction under Section 87A.

This is the second change to the new structure of the tax system in as many years. Last year’s budget reduced the number of papers from seven to six and extended the cuts common to the new regime. Let me explain:

Improving Financial Stability for Retirees

The Budget 2024 proposes to increase the reduction in family pension from ₹15,000 to ₹25,000, to provide greater financial stability for pensioners. Meanwhile, taxpayers who choose the old tax regime will not see any changes to their tax bills, as no reforms have been announced for the system.

To facilitate capital gains through real estate:

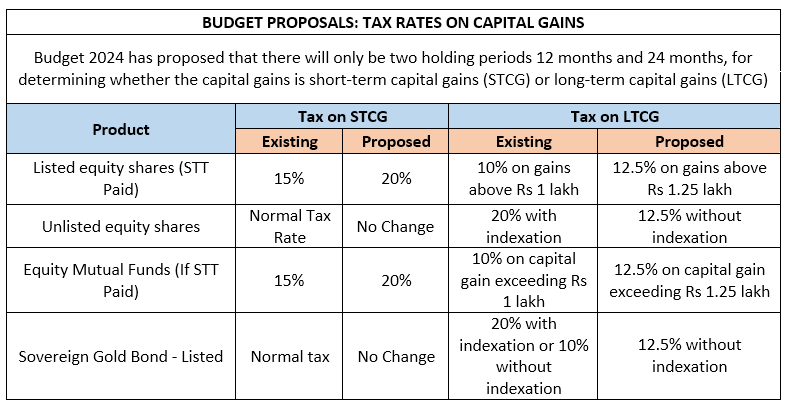

The Budget 2024 has removed the benefit of indexation for property sales, changing the way capital gains are calculated. In the past, sellers could adjust their price for inflation, reduce their taxable income, and be taxed at 20 percent on long-term capital gains (LTCG). Now, the LTCG tax rate has been reduced to 12.5 percent, but without adjustment for inflation.

Here is an example to show this change:

Mr A purchased a plot of land for ₹50 lakh in FY 2004-2005. He is selling the property in FY 2023-2024 for ₹1.5 crore. Under the previous rules, the price of ₹50 lakh would be adjusted for inflation using the Inflation Index (CII) numbers provided by the Income Tax Department. However, under the new rules, there will be no adjustment for inflation. Capital gains will be calculated by subtracting the purchase price directly from the sales price. While the good news is that the LTCG tax rate has been reduced from 20 per cent to 12.5 per cent, the lack of indexation requires careful calculations to determine the actual tax effect.

Also Read- Budget 2024: Higher tax for stock market investors, F&O clampdown

The aim is to simplify capital gains tax by reducing the LTCG tax rate to 12.5 per cent and removing the benefit of indexation. This change is intended to make capital gains calculations easier for taxpayers and tax authorities.

How Indexation Flows Affect Real Estate Investors

The elimination of indexation benefits poses a challenge for long-term real estate investors. Without this change, taxable income is likely to rise, increasing the tax burden on property sales. This can reduce profits and discourage real estate investment, especially for long-term holders where inflation has had a significant impact.

New Tax Relief for Multiple Properties and Short-Term Rentals

Under the new tax rules, individuals can now designate up to two properties as private. This change is good for landlords who have a lot of property or who rent out houses through temporary platforms like Airbnb, to provide relief and to simplify the tax system.

Increase in Long Term Capital Gains Tax on financial assets

Long-term Capital gains tax (LTCG) has been increased from 10 percent to 12.5 percent across all financial and non-financial assets. Short-term capital gains (STCG) on certain properties will now be taxed at 20 percent. The exemption limit for LTCG has also increased from ₹1 lakh to ₹1.25 lakh. The standard specifies that listed financial assets held for more than one year will be considered long-term, while unlisted financial assets and non-financial assets must be held for at least two years to qualify. .

Also Read- Budget 2024 is an ambition for equitable growth: CRISIL

I can see these changes may raise concerns about future tax increases, but it’s important to remember that equity gains can offset some of these taxes. Equity mutual funds remain a compelling investment option. As I always say, “Death and taxes are fixed,” so focusing on maximizing your income and managing your means is key.

Highlights of Budget 2024: Increase in STT and Improvements in NPS

STT Increase for Futures and Options:

Futures and Options (F&O) traders will face a significant tax increase as the Securities Transaction Tax (STT) rises from 0.01 percent to 0.02 percent. This change will have a double effect on equity tax and index trades.

Increase in NPS Tax Deduction:

The employer deduction limit in the New Pension Scheme (NPS) is set to increase from 10 percent to 14 percent. This improvement will benefit both public and private sector employees, run away from their tax and government employee benefits.

Introduction of NPS Vatsalya for Children:

The new NPS Vatsalya scheme allows parents to contribute to the child’s NPS account, which will convert to a regular NPS plan on the child’s 18th birthday. The scheme encourages early financial discipline and switching to a regular NPS plan.

Changes to the Buyback Tax and Reporting Requirements

Taxable Buybacks as Shares:

Starting October 1, stocks will be taxed as dividend income, greatly reducing their appeal to investors. This proposal could change investment patterns, making buying later less likely than before.

Reduced Penalties for Foreign Assets:

The bill introduces relaxation in penalties for non-declaration of foreign assets up to ₹20 lakh. This change is intended to ease the burden on small taxpayers who may have deliberately neglected to report offshore assets.

Enabled TDS for Salaried Employees:

From October 1, salaried employees will benefit from Tax Deducted at Source (TDS) as they can now declare Tax Collected at Source (TCS) to their employers. This development will help manage cash flow better and allow any refund due to be adjusted directly against TDS.

These changes bring challenges and opportunities. The change in repurchase tax may prompt investors to reassess their policies, while the reduced penalties and amended TDS rules provide significant relief to taxpayers. It is important to stay informed and adapt to these developments to improve your financial planning.

The author is a Chartered Accountant and founder of NRP Capitals.

The views and opinions shared here are those of the author.

Check out our last minute subscription discounts with a free Moneycontrol pro subscription. Use code EOSO2021. Click here for details.

#Budget #Affect #Finances #Forbes #India #Blogs